In contrast to other bubble episodes, the upside lay almost wholly in the response it stimulated. As part of the New Deal, the Roosevelt Administration and Congress created a new financial infrastructure for the nation: the Federal Deposit Insurance Corporation, which made it safe for people to bank again, the Securities and Exchange Commission, which made it safe for people to invest again, and the Investment Company Act, which laid the foundation for the modern asset management business. This infrastructure helped bring into being the nation's capital-intensive, credit-driven economy and paved the way for America's global financial dominance in the second half the 20th century.

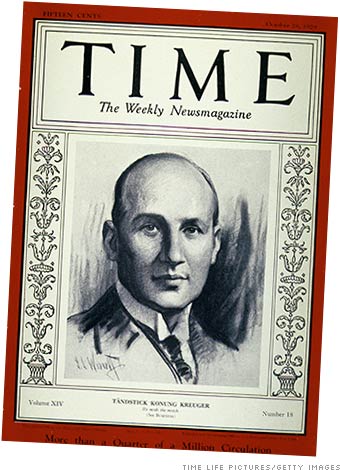

Financier

Ivar Kreuger, known as the "Swedish Match King," was a leading figure

in the 1920s boom. Disgraced after the market crash, he committed

suicide in Paris in 1932.

'나의 서재 > 경제:경제학현실에 말을 걸다' 카테고리의 다른 글

| [스크랩] imf 와 경제 (0) | 2009.03.08 |

|---|---|

| The bubbles that built America-internet 인터넷 거품 (0) | 2007.05.16 |

| The bubbles that built America - The railroad 물류인프라 거품 (0) | 2007.05.16 |

| The bubbles that built America - The telegraph 전화 전신 거품 (0) | 2007.05.16 |

| 인류 역사 바꿔 놓은 6대 버블 - 경제는 복잡계 (0) | 2007.05.16 |