Real estate

Thanks to the good offices of Federal Reserve Chairman Greenspan, the

U.S. economy cycled almost directly from the dot-com bubble into a real

estate and housing credit bubble. As housing prices soared and

McMansions bloomed in new subdivisions, the mortgage industry developed

funky new products (interest-only and 40-year mortgages) and millions

of Americans began to view houses as flippable assets. In 2005, 28

percent of homes bought in 2005 were purchased as investments. The S&P Homebuilders Index rose six-fold between September 2001 and July 2005. With house prices falling nationwide and subprime lenders plummeting into bankruptcy, the bubble has clearly burst. What will be the upside? It's too soon to tell.

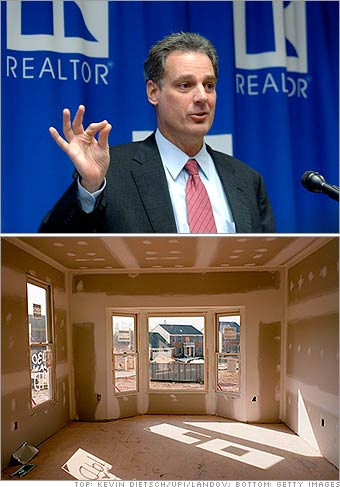

With

his relentlessly upbeat pronouncements, National Association of

Realtors Economist David Lereah became a mascot of the housing boom -

and a target of derision when the bubble burst.